The trust seeks to achieve its investment objective by investing primarily in equity securities issued by companies that are engaged in the utilities infrastructure.

Blackrock renewable energy infrastructure fund.

Global renewables power fund iii was launched in the first quarter of this year and is targeting a gross irr of 12 13 percent and a gross yield of 5 7 percent according to pension documents.

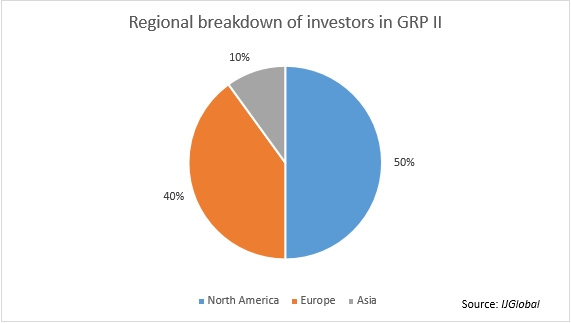

The second launched a few years later brought in 1 65 billion.

Blackrock utilities infrastructure power opportunities trust s bui the trust investment objective is to provide total return through a combination of current income current gains and long term capital appreciation.

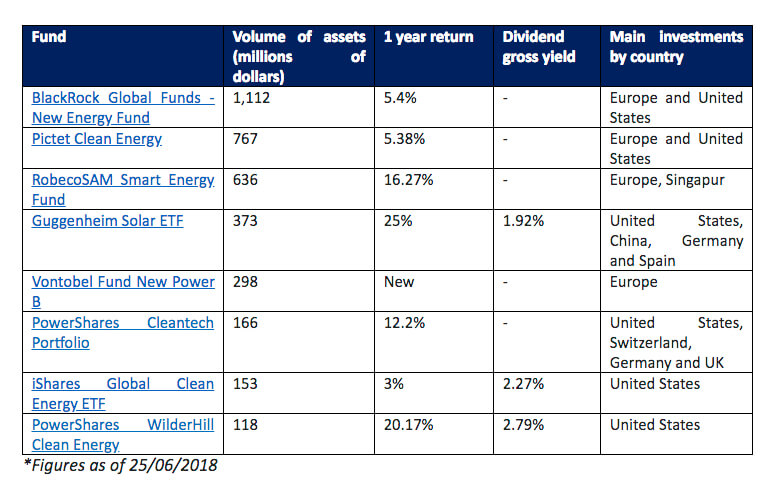

Sustainable energy companies are those which are engaged in alternative energy and energy technologies including.

Blackrock s global energy power infrastructure fund gepif has achieved a us 5 1 billion final close of global energy power infrastructure fund iii gepif iii or the fund making it the largest alternative investment fundraise in blackrock.

The fund invests globally at least 70 of its total assets in the equity securities of sustainable energy companies.

Fund close marks the largest alternative asset fundraise in blackrock history fund size exceeds original target and fund hard cap.

Blackrock s first renewables private equity fund drew around 600 million of commitments from big investors.

New york business wire blackrock s global energy power infrastructure fund gepif has achieved a us 5 1 billion final close of global energy power infrastructure fund iii.

Grp iii the third vintage of blackrock s global renewable power fund series targets investment in a wide range of climate infrastructure assets with a focus on renewable power generation and energy storage and distribution.

Blackrock real assets has begun fundraising for its third global renewables fund targeting 2 5 billion in commitments infrastructure investor understands.

The fund was launched at the start of this year with the aim of raising usd 2 5 billion.

This presents a 9 trillion climate infrastructure.

In infrastructure we expect renewable energy again to be the sector with the most investment activity following a year when it accounted for more than 50 of investment activity.

Over the next 30 years there will be a shift in global power generation from two thirds fossil fuels to two thirds renewables.

Global climate infrastructure investments primarily in renewable power seeking financial returns with a purpose.

.jpg)